In Silicon Valley, we know Winter when we see it. The weather cools, there’s less daylight, and it rains a lot. But I’m not talking about the annual winter on the calendar. We’re talking about Startup Winter.

In Silicon Valley, we know Winter when we see it. The weather cools, there’s less daylight, and it rains a lot. But I’m not talking about the annual winter on the calendar. We’re talking about Startup Winter.

This post is inspired by startup guru Eric Reis who recently offered his own take on current events, with a thoughtful warning that Winter is Coming. Startup Winter occurs when startup financing goes cold. Most people believe we’ve been enjoying a Startup Summer filled with plenty of funding and lucrative exits.

If indeed Winter arrives soon, this will be the third Winter in Silicon Valley since 2000 (including the nuclear winter of the dotcom bust.) Are there any patterns in the previous two downturns that might guide entrepreneurs to survive the next one?

Opportunity Slows but Innovation Doesn’t

During the last two Winters it was hard to get a financing deal done. Venture investors (including many angels) spent more time on portfolio triage and less time on new investments. Expect that pattern to repeat in the next Winter. But the thing you don’t often hear is that even in the nuclear Winter of 2001, series A financings were still happening. Indeed there were way less of them. But the innovation engine never stops, and there was still plenty of dry powder (the name for cash in a downturn) looking for a good home. What does this mean for a Winter entreprenuer?

Stop Thinking “Startup”, Start Thinking “Good Business”

In Summer, financing happens everywhere. We see a sort of gold rush of ideas (which by itself is not a bad thing). But exuberance takes hold, valuations get frothy, and before long we are at a point where numerous “wantrapenuers” are taking something that is really a project, calling it a startup, and successfully raising money. So it’s not totally surprising when a downturn starts draining the water out of Lake Exuberance and suddenly all the sandbars are exposed again.

In Winter, there is still money available, but only for a “good business”. The trick is that the threshold of proof that a startup can become a good business is higher.

What’s a Good Business?

Every venture investor (including VC’s, super-angels, regular angels, or your rich uncle) is different in how they choose to invest. There is no one-size-fits-all formula for a startup to raise money. That said, the true north on the compass for most any Winter investor is demonstrated proof of a repeatable business model. Investors in startups, regardless of season, are always interested when “dollars in” can be connected to “dollars out” in a credible, scalable way. This doesn’t mean you are killing it with revenue yet. But it does mean you can demonstrate on a small but repeatable level that you know exactly where and how to spend money that in turn makes more money.

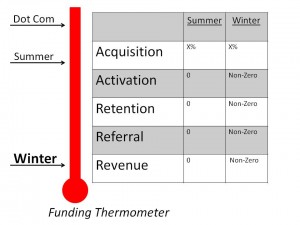

One way to envision this idea is to take Dave McClure’s AARRR model, and add a thermometer that shows where investment happens according to season:

Needless to say, the dotcom boom set record temperatures. The mid-2000 Web 2.0 bubble was comparably cooler but still pleasantly warm. Summer, as noted on the thermometer, is a time when startups that are able to grow users, but have yet to make subsequent progress beyond Activation, can nonetheless raise plenty of money. In fact, I just met with an entrepreneur last week who is about to launch a social media startup (it’s actually something interesting and new) and is confident in raising money after some level of user growth. Despite my advice, he has little interest in developing, let alone proving, his monetization strategy. So he will have Activation, but the rest of the rows will be zero. He is basically betting there is still time to get over the fundraising mountain before Winter hits.

Repeatable Business Model

No one knows for sure when the next Winter will hit, or how cold it will be. But the point is this – entreprenuers won’t care what season it is if they keep their burn rate low while they work their way down the chart until they get to revenue. This does not require huge overall numbers. The idea is to test, measure and tune each of the core assumptions in business and growth models until you get it right – until you show revenue actually works, with clear elements of scalability. Think of it as iteratively converging on conversion. As Dave McClure says, double down after product-market fit.

Not Risk Capital

Sometimes entrepreneurs get frustrated (or even scoff) at developing greater levels of business proof. Unfortunately, even after locking into a repeatable business model, plenty of risk still remains in the startup before investors have a shot at seeing real ROI. Back when I was raising money for the first time, Chris Marino, who was then founder and CEO of Resonate, gave me great advice – never think of venture capital as risk capital. Investors, even venture investors, aren’t doing this because they love risk. They are just looking to put money to work in a good business. Regardless of the season.

Perhaps the most important observation from the last two Winters is this – Winter does end. And if you play your cards right, you will be one the skiing on all that leftover snow.

What is your best advice for surviving Startup Winter?

Speak Your Mind