Most real startups don’t grow like this:

Instead, most successful startups grow like this:

Instead, most successful startups grow like this:

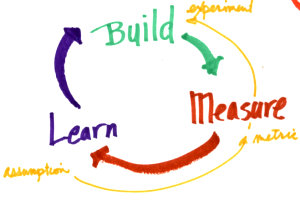

Those initial loops are unsuccessful attempts to create a product people want to use. The problem is those loops can take months and/or millions of dollars to get through, and many startups never get there. But a startup can get through at least one or two of those loops quickly, in a matter of a few short weeks, by using a new concept called Monetizable Pain.

The Nice-To-Have

On paper, in hindsight, those loops look like failures. In practice, in the trenches, it’s never so obvious. The loops always start off sounding like a good idea full of possibility. But before long, after development and launch, it becomes apparent that while interesting, the product is somehow not necessary enough, or useful enough, to really build a business around, even if it’s well designed. It’s merely a nice-to-have product, one that addresses what Paul Ahlstrom and Nathan Furr, in their new book Nail It Then Scale It, call a “mosquito bite”.

Nice-to-have products are often wonderfully designed and work well. An example is scanR. They built a nice mobile app that turns the camera on your phone into a wireless document scanner. Users liked it. Unfortunately the team ran into challenges building a business around the concept. ScanR, like many smart, capable startups, found that “like” does not easily convert into “here’s my credit card number.” (Just ask any business trying to measure ROI on FaceBook “Likes”.)

The Must Have

The part of the curve on the right, where things are finally looking up, is where a startup has figured out how to offer a must-have. This part arrives when the company gets two things right at the same time:

- It is now focused on monetizable pain – a problem that Furr and Ahlstrom refer to as a “shark bite”.

- It is offering a solution that provides a direct, meaningful level of relief for that problem. (Without adding too many new hassles in the process.)

It’s important to note that a viable solution in the must-have part of the curve is not necessarily a mainstream product like the classic model in Geoffrey Moore’s Crossing the Chasm. Nonetheless, the product begins to sell, and/or the users begin to grow. In my first startup, NetMind, our first customers were Boeing, eBay, IBM and the CIA and I promise you they did not fit the classic profile of an “early adopter” who is tolerant of a crappy product. They were not remotely interested in bleeding edge, early stage solutions. But they had monetizable pain, and we had something that provided real (albeit small, initially) relief. So they bought it. And that began a long journey that eventually ended in an $800 million acquisition.

The Must-Have Shortcut

Most of the good startup wisdom out there, from Lean Startup, to Customer Development, to Y Combinator, emphasize engaging customers early by building something that offers the product concept or a product feature and then measuring customer/user response. This method is way smarter and faster than the old startup (and current big company) process of building out a real product and hoping users come. However, there is a first step that can get you to must-have and product/market fit even faster.

Validate Monetizable Pain First

Offering a minimum viable product is a fantastic way to learn what target customers want. I do it all the time. The only problem is the learnings you get don’t always lead to a breakthrough product focused on monetizable pain. The reason?

Monetizable pain is about the customer’s problem, not the startup’s product.

For that reason, the first step on the road to product/market fit for any startup is to go deep on the customer problem and test for monetizable pain before building anything.

The monetizable pain discovery and testing methodology is quite aligned with Customer Development, except we’ve found it’s very beneficial to work through the monetizable pain process before (rather than concurrently with) initial product development. While it sounds heretical to delay development, the reality is no proposed product spec has ever survived the monetizable pain discovery process. It’s a process that forces the entrepreneur to know more about the problem than any one target customer, and it turns out that 100% of all product visions change during this step. And the process of locking on to monetizable pain does not have to take long – if you do it right.

How to Validate Monetizable Pain

Validating monetizable pain requires a method for measuring the value of a problem. It requires the development of a reliable metric for customer problems. Unfortunately the well known business metrics don’t really help us because they have much more to do with the solution side of the equation. For instance, one obvious business metric is sales. Sales can measure the success of a product. But nobody buys problems. (They unfortunately arrive free of charge.)

One way to accurately measure a customer problem is to rely on this principle:

The value of a problem directly correlates to the time people will take to tell you about it.

Time and time again we find that if busy people, who fit your target customer profile, are willing to give you valuable time simply to discuss a particular problem, with no clear promise (yet) of a viable solution, then you have an important problem. The kind of problem a startup, with limited resources, no brand, an incomplete product and a small team can actually sell into.

My Favorite Test for Monetizable Pain in B2B

Our favorite (and most dramatic) monetizable pain test has been proven to work well across a number of different B2B market segments. The B2C tests are different and very interesting as well. The posts on those are coming.

This B2B test works like this:

Place a true cold call to your hypothetical target customer – meaning the actual role/title of the person in the big name brand you would actually like to sell to – and leave a voice message that does little more than ask, “Do you have this problem?”

It sounds crazy. And even though I’ve done it a lot, I still get nervous making the calls. But if it is a monetizable pain problem, and you indeed say the problem the right way ( the right specific description using their jargon), to one of the people in the organization who most feels the problem, they call you back. In fact, we use a rule that its not monetizable pain unless 50% of the target customers call you back.

My marketing brethren find this hard to believe at first because they live in a world where a single digit response rate is celebrated. The monetizable pain test, however, is quite different. It’s not a marketing campaign. We’re not selling anything, even if at the end they want to buy. (Which sometimes happens, and that’s an important scenario that I’ll post about soon.)

In fact, there are key things to say in the call that make the differences clear. I will share more in the next post (sorry, I’m not trying to leave anyone hanging, just need to wrap this post.)

Four Important Words

There are important nuances to the call script, and very important structure to the short but sweet interview you do when they call back. For now, I’ll share the most important thing to say in the cold call – probably the four most important words after your problem description – “I’m not selling anything.” This sentence alone distinguishes the process and makes you sound completely different on the phone.

Beware

There is so much more to this so if you decide to try it on your own, please wait until I share more in the next post or contact me. Hopefully you have enough to be interested. Unfortunately this is not quite yet enough to give you meaningful data from the test yet.

Next up: real examples – real results.

Please share in the comments if you have ever tried cold calling target customers…..were you nervous?

Other ways to connect